Strategy selling put options

An Interview with Dr. Stansberry Research LLC Stansberry Research is a publishing company and the indicators, strategies, reports, articles and all other features of our products are provided for informational and educational purposes only and should not be construed as personalized investment advice.

Our recommendations and analysis are based on SEC filings, current events, interviews, corporate press releases, and what we've learned as financial journalists. It may contain errors and you shouldn't make any investment decision based solely on what you read here.

It's your money and your responsibility. Readers should be aware that trading stocks and all other financial instruments involves risk. Past performance is no guarantee of future results, and we make no representation that any customer will or is likely to achieve similar results. Our testimonials are the words of real subscribers received in real letters, emails, and other feedback who have not been paid for their testimonials. Testimonials are printed under aliases to protect privacy, and edited for length.

Their claims have not been independently verified or audited for accuracy. We do not know how much money was risked, what portion of their total portfolio was allocated, or how long they owned the security.

We do not claim that the results experienced by such subscribers are typical and you will likely have different results. Any performance results of our recommendations prepared by Stansberry Research are not based on actual trading of securities but are instead based on a hypothetical trading account.

Hypothetical performance results have many inherent limitations. Your actual results may vary. Stansberry Research expressly forbids its writers from having a financial interest in any security they recommend to our subscribers. And all Stansberry Research and affiliated companiesemployees, and agents must wait 24 hours after an initial trade recommendation is published on the Internet, or 72 hours after a direct mail publication is sent, before acting on that recommendation.

Customer Service 1 Access your Subscriptions.

Analysts Flavious Smith Brett Aitken Ben Morris Brett Eversole Bryan Beach Mike DiBiase Steve Sjuggerud Dr.

David Eifrig Dan Ferris Porter Stansberry Dave Lashmet Guest Editors Peter Churchouse Meb Faber Kim Iskyan Richard Smith Justin Brill Tom Dyson Mark Ford Doug Casey Chris Mayer Friends of Stansberry Research TradeStops Gold Stock Analyst David Hall Rare Coins Common Sense Publishing Asset Strategies International Casey Research.

Or Just a Headache? Selling Puts An Interview with Dr. According to Stansberry Research founder Porter Stansberry, most people will probably never get involved in options You have to do what you're comfortable with You do this by selling options, not buying them.

Buying options can be incredibly risky. As Porter explains, "It's a strategy that should be used mostly by professional investors to hedge against losses — insurance, essentially. Buying options is a cost of doing business for professional fund managers. Selling those options is an easy way for us to generate large amounts of safe income. How safe is selling options? To discuss this idea, we sat down with Dr. David Eifrig, who has been showing readers of his Retirement Trader advisory how to use options to generate safe income.

Doc, you've told folks looking for a conservative, high-income, retirement-friendly trading strategy they can't find a better tool than selling put options. Can you explain how this strategy works? Put options work the same way as homeowners insurance. When you insure your home, you are simply buying the right to sell your house to the insurance company if certain things happen, like a fire or a storm.

In return for that protection, you pay the insurance company a certain fee — known as the insurance premium — to accept those terms, whether or not you ever actually exercise the insurance policy.

And most homes don't burn down Most homes don't blow away in a storm. With put options, instead of buying the protection, you're acting like the insurance company.

You see, when you sell a put option, you're forex histoire to buy someone else's stock at a certain price — known as the "strike" price — under certain conditions, for a limited period of time. In return, you're getting paid a certain fee — the option premium — to accept those terms. In the example of home insurance, a person would exercise the policy only after a catastrophic event Again, a put option works the same way.

In this case, the holder would exercise his right to sell the stock to you only if the market value of the stock falls below the strike price you agreed to pay. If the stock goes up or even stays where it is — as long as it doesn't fall below the strike price — you get to keep your premium. If it does drop below that price, you're obligated to buy the stock, but the premium you received ensures you get a discount to the current price. And the best part of the strategy is you don't have to be right forever.

You just need to courses for stock market in kolkata right for a few months, because your obligation to buy expires when the option expires.

It's a big, strong company, it pays a growing dividend, and it stands to benefit from one of the biggest trends in the world: In earlythe company announced some product recalls that caused the shares to sell off a bit. But the company had moved to correct the problems, so I thought the selling was overdone And the company had just released a great earnings report.

So shares were cheaper, but all the great points I mentioned earlier were still intact. So we took advantage in Retirement Trader and sold puts on JNJ. Like all put-selling trades, there were two potential outcomes here. On the other hand, if the stock fell below our strike price, we'd own the shares at a discount to the even cheaper price. But what happens if the stock crashes, say because of an accounting scandal or a major product recall?

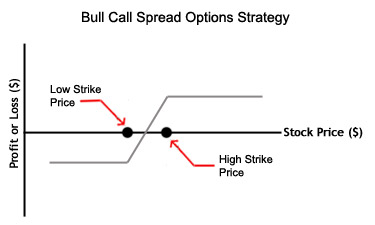

Call Option Strategies ~ Best Option Strategy

In that scenario, you would have to buy a stock for much more than it is currently trading for. It could happen because every investment carries risk, and no one can predict the future. So, one key to selling puts safely is figuring out what the company's stock is really worth and trading the best companies.

Just like an insurance company needs strategy selling put options know the details of your home — things like how much you paid for it, how big it is, the value of any valuables you have, and so on — you need to know the details of the companies you sell puts on to be sure they're fundamentally sound.

An insurance company wouldn't want to insure an old house with a faulty electrical system. Similarly, you don't want to "insure" just any stock. You want to find quality stocks that you like and would want to own anyway. Then, you "insure" them — sell puts on them — at a price they aren't likely to drop below. Since you're only agreeing to buy the stock below the strike price, you're safe as long as it doesn't completely crash.

Again, this is why you want to stick with quality companies. When this strategy is used correctly, you won't end up buying very many stocks But it's no problem if you do end up buying a few stocks.

If you follow a few simple rules, you'll own some great dividend-paying companies at great prices that will compound your wealth for years. You've made a convincing case for selling put options.

No other strategy offers a chance to safely profit, no matter what happens to stock prices. I truly believe it's one of the most valuable investing skills you can learn. Contrary to popular opinion, I think it's within reach of any serious investor.

It does require some education for most folks to become proficient, but there are a number of free resources available out there. The time and effort you spend learning will be well worth it. Of course, I invite folks to take a look at my Retirement Trader advisory as well. Our goal is not only to find the safest and most profitable trades, but to educate. In fact, if most subscribers don't eventually become proficient at finding and making these trades for themselves, I'm not doing my job.

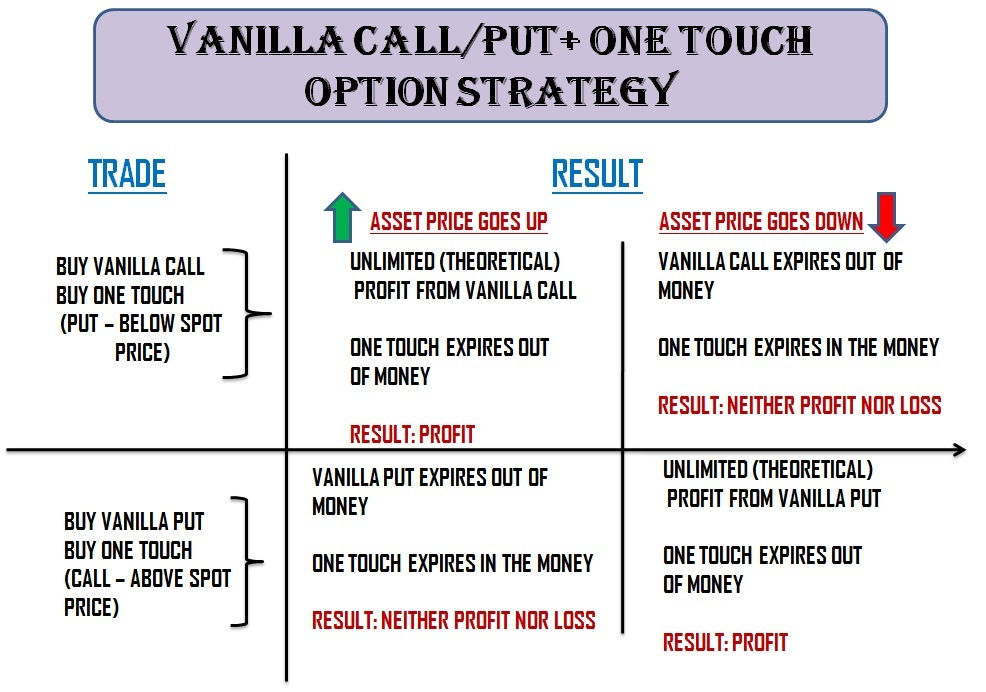

How To Sell Calls And Puts - Fidelity Viewpoints

Selling puts is a simple way to generate income and potentially "buy" the stocks you want to own, at the exact price you want to pay, while minimizing risk and greatly increasing potential returns. How to Read an Option Symbol By Amber Lee Mason and Brian Hunt. The Trailing Stop Strategy By Steve Sjuggerud. Anaconda Trading An Interview with Dr. Selling Covered Calls An Interview with Jeff Clark.

Judging Investor Sentiment An Interview with Steve Sjuggerud. Picks and Shovels An Interview with Brian Hunt. Position Audit An Interview with Brian Hunt. Position Sizing An Interview with Brian Hunt. Short Selling An Interview with Jeff Clark.

Common Sense Technical Analysis An Interview with Brian Hunt. Stansberry Research DailyWealth Retirement Millionaire Daily The Crux Stansberry Conference Series Porter Stansberry E-letters and Podcasts Investing Services Lifetime Memberships Trading Services Press Room Media Kit Testimonials Friends of Stansberry Research Partner with us FAQ General Archive Stansberry Digest Public Archive.

Privacy Policy Customer Service. Protected by copyright laws of the United States and international treaties. This website may only be used pursuant to the subscription agreement and any reproduction, copying, or redistribution electronic or otherwise, including on the world wide webin whole or in part, is strictly prohibited without the express written permission of Stansberry Research, LLC.