Mean reversion trading systems bandy pdf

I have been following your blog for a while. But I am now surprised because you commend the work of someone who claims in his book that: The only way to determine the length of the in-sample period is to run some tests.

As long as the model and the market remain in sync and the system remains profitable. There is no general relationship between the length of the out-of-sample period and the length of the in-sample period.

Mean Reversion Trading Systems - Dr Howard B uqyhadet.web.fc2.com - 下载 - 人大经济论坛

I wonder why you endorse such stuff. What do you have to gain. Or maybe because I respect your work maybe you overlooked the details. The substance in trading is in the details. What a sad world when saying something nice about someone else's work brings emails asking me what I have to gain.

The review got me a nice thank you note from Mr. Bandy, whom I have never met nor spoken to before. While he views some aspects of testing differently than I, I have no interest in arguing every point he makes in his book. For me, if you can take valuable ideas and information from a book, then it is worthwhile.

This one is filled with them. I stand by my review. I thought the book had lots of great info. It was backed up by actual test results a rarityand since he provides all the code, traders can verify the results and easily explore the ideas further on their own.

Those who have read the book are welcome to post comments positive or negative below. You all know my opinion. Instead of feelling sad, maybe you should be happy that someone took the time to point out to you the mistakes in that book which are of fundamental nature, i.

The world is not sad when we go against reality, we should just change course. I received Howard's book yesterday, and while I haven't finished it yet, I think the 'data snooping' comment is a bit over the top.

Howard is constantly cautioning about 'future leaks' and day trading authority podcast optimization techniques. Perhaps mati should actually purchase the book before dissing it mean reversion trading systems bandy pdf his level. I came across this comment and as someone who has mean reversion trading systems bandy pdf four of Dr Bandy's books, I felt I should chime in on this topic.

Dr Bandy is a strong proponent of good system development practices and his writings clearly warn about the real dangers of curve-fitting.

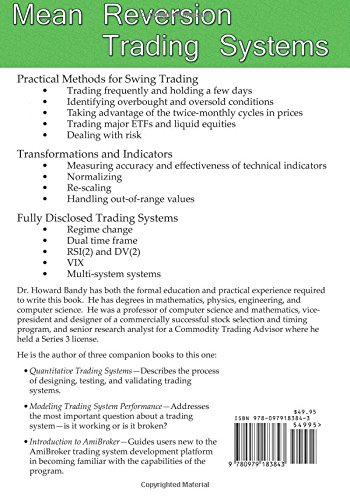

Dr Bandy has become my favorite author on the topic of quantitative trading approaches. Assessing Market Action With Indicators And History. Friday, March 8, Book Review - Mean Reversion Trading Systems by Howard Bandy. While I very rarely review books here on Quantifiable Edges, this one really stands out and deserves some attention.

Howard goes through every step of the systems-building process. He examines several different oscillators. He discusses risk control. And on top of it all, he provides code for forex fpi indicator he covers in the book. All of the coding is done in Amibroker, which unfortunately I do not use.

But since he lists it all out, those who use other programs like me can translate it into Tradestation, R, or whatever.

Mean Reversion Trading Systems: Dr Howard B Bandy: uqyhadet.web.fc2.com: Books

And here is the kicker for anyone that does use Amibroker — Howard has actually set up a web page where book purchasers can download the code at no additional cost. I commend Howard on his efforts. If you have an interest in developing your own trading systems, this book is a wonderful resource that I would highly recommend.

Posted by Rob Hanna at Newer 99 binary option trading itunes Older Post Home.

Subscribe to Rfxt royal forex trading Edges Blog Free Subscribe to Quantifiable Edges by Email. Link to Quantifiable Edges Home Page Members Area Quantifiable Edges Charts Quantifiable Edges Systems Quantifinder Quantifinder Intraday.

Premium Subscription Options Gold Level - Includes nightly Subscriber Letter, the Quantifinder, Charts, Systems, and Downloadable CBI History, Webinars, nightly archives and more. Silver Level - Includes weekly Research Letter, Charts pages, and weekly archives. An Unusual And Potentially Short-Term Bearish In A Fed Day Setup That Has Seen SPX Higher 3 Days La The 1st Short-Term Closing Low In A While Large Gaps Down When The Market Was Near A Long-Te Reviewing Performance After Strong Closes Going In Putting A Series Of Higher Highs Into Context An Updated Look At Op-Ex Week Returns By Month Book Review - Mean Reversion Trading Systems by Ho Purpose In this blog I will be examining market action and quantifying my findings.

Using sentiment, breadth, price and volume indicators - both standard and customized - I will try and uncover short-term edges which could be taken advantage of by market participants. I will frequently add opinion to these studies and may sometimes post opinions without quantifiable research behind them.

[] Howard B Bandy eBooks [Quantitative Trading] [Archive] - World Wide Invest - Forex Forum

It is NOT a recommendation or advice to buy or sell any securities. I may hold positions for myself or clients in the securities or industries mentioned here. There is a very high degree of risk involved in trading securities. Your use of any information on this site is entirely at your own risk. About Me Rob Hanna I have traded professionally since From January through February my bi-weekly column "Rob Hanna's Putting It All Together" appeared on TradingMarkets.

I have been conducting quantitative research and designing trading systems - mostly focused on short-term edges since View my complete profile. Labels Quantitative Study seasonality 75 gaps 61 VIX 48 Breadth 43 volume 43 CBI 40 Fed Study 30 IBD Follow Through Day 24 Subscriber Letter 14 reversal bar 12 Intraday 11 Using Quantifiable Edges 11 Spyx 10 Capitulation 7 System 7 NYSE Net New Highs 6 Trend Vs.