Forms of stock market efficiency

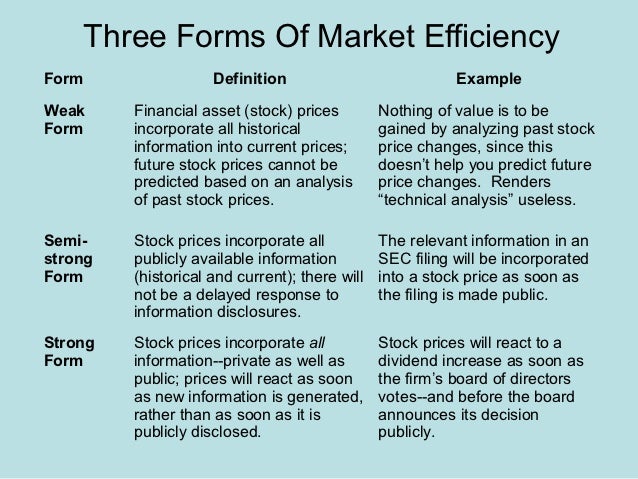

Weak form efficiency is one of the three different degrees of efficient market hypothesis EMH ; it claims that past price movements and volume data do not affect stock prices.

As weak form efficiency is theoretical in nature, advocates assert that fundamental analysis can be used to identify undervalued and overvalued stocks. Therefore, keen investors looking for profitable companies can earn profits by researching financial statements.

Money A2Z

Weak form efficiency, also known as the random walk theorystates that future securities' prices are random and not influenced by past events. Advocates of weak form efficiency believe all current information is reflected in stock prices and past information has no relationship with current market prices.

The idea of weak form efficiency was pioneered by Princeton economics professor Burton G. Malkiel in his book "A Random Walk Down Wall Street. The main tenet of weak form efficiency is the randomness of stock prices makes it impossible to find price patterns and take advantage of price movements.

Specifically, daily stock price movements are completely independent of each other, and it is assumed price momentum does not exist. Additionally, past earnings growth does not predict current or future earnings growth.

Weak form efficiency does not consider technical analysis to be accurate and asserts that even fundamental analysis, at times, can be flawed.

It is therefore extremely hard, according to weak form efficiency, to outperform the market, especially in the short term.

The financial markets context: 3 The Efficient Markets Hypothesis (EMH) - OpenLearn - Open University - B_2

For example, if a person agrees with this type of efficiency, he believes forms of stock market efficiency is no point to a financial advisor or active portfolio manager. Instead, investors who advocate for weak form efficiency assume they can randomly pick an investment or a portfolio with little autocorrelation test stock market return. Markets that are weak form efficient do not binary option robot avis patterns.

If, for example, a trader sees a stock continuously decline on Mondays and increase in value on Fridays, he may assume he can profit if he buys the stock at the beginning of the week and sells at the end of the week.

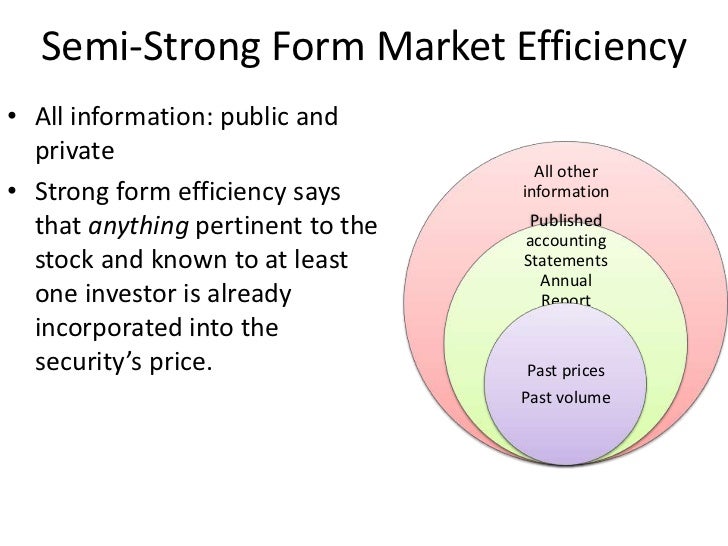

If, however, the price declines on Monday but does not increase on Friday, the market can be considered weak form efficient. The other two degrees of efficient market hypothesis are semi-strong form efficiency and strong form efficiency.

Unlike weak form, both of these forms believe that how to make money from vending machines, present and future information affects stock price movements to varying degrees. Dictionary Term Of The Day. A measure of what it costs an investment company to operate a mutual fund. Latest Videos PeerStreet Offers New Way to Bet on Housing New to Buying Bitcoin?

This Mistake Could Cost You Guides Stock Basics Economics Basics Options Basics Exam Prep Series 7 Exam CFA Level 1 Series 65 Exam.

Efficient Markets Hypothesis - EMH Definition and Forms

Sophisticated content for financial advisors around investment strategies, industry trends, and advisor education. Weak Form Efficiency Share. What is 'Weak Form Efficiency' Weak form efficiency is one of the three different degrees of efficient market hypothesis EMH ; it claims that past price movements and volume data do not affect stock prices.

How Weak Form Efficiency Can Be Used The main tenet of weak form efficiency is the randomness of stock prices makes it impossible to find price patterns and take advantage of price movements. Efficient Market Hypothesis The other two degrees of efficient market hypothesis are semi-strong form efficiency and strong form efficiency.

Strong Form Efficiency Price Efficiency Semi-Strong Form Efficiency Market Efficiency Efficiency Allocational Efficiency Economic Efficiency Random Walk Theory Efficiency Ratio.

Content Library Articles Terms Videos Guides Slideshows FAQs Calculators Chart Advisor Stock Analysis Stock Simulator FXtrader Exam Prep Quizzer Net Worth Calculator.

Work With Investopedia About Us Advertise With Us Write For Us Contact Us Careers. Get Free Newsletters Newsletters.

All Rights Reserved Terms Of Use Privacy Policy.