Weak form efficiency indian stock markets

About The Authors Rakesh Gupta Central Queensland University Australia. Basu Charles Sturt University Australia.

Article Tools Print this article. How to cite item.

Efficient Market Hypothesis Video InvestopediaUser Username Password Remember me. Journal Content Search Search Scope All Authors Title Abstract Index terms Full Text Browse By Issue By Author By Title Other Journals.

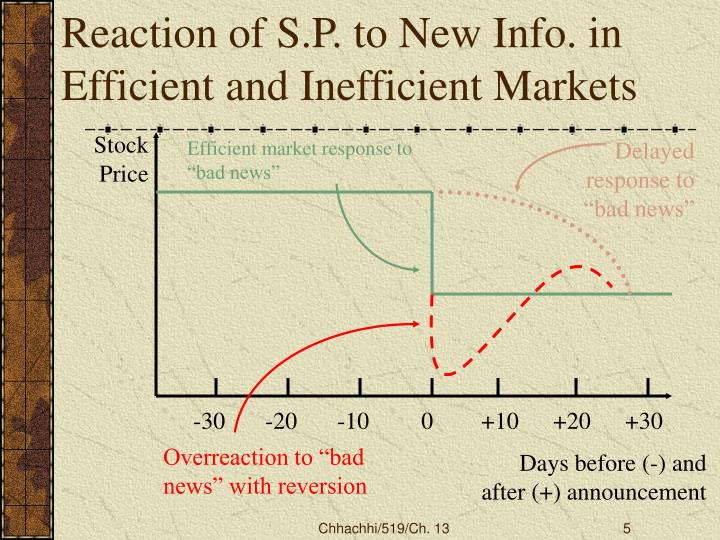

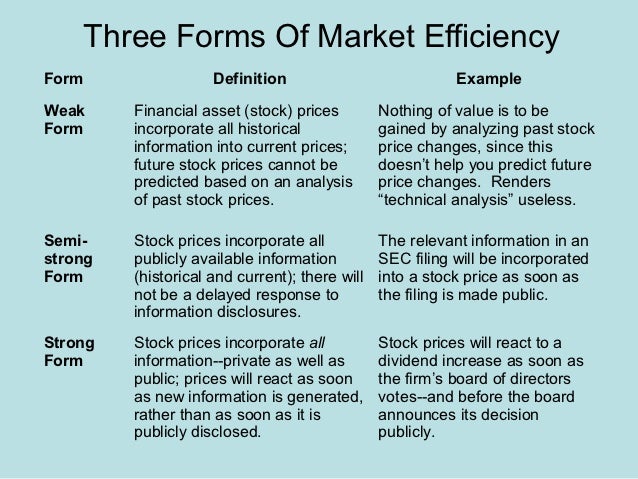

Abstract Hypothesis of Market Efficiency is an important concept for the investors who wish to hold internationally diversified portfolios. With increased movement of investments across international boundaries owing to the integration of world economies, the understanding of efficiency of the emerging markets is also gaining greater importance. In this paper we test the exchange rate forecast usd zar form efficiency weak form efficiency indian stock markets the framework of random walk hypothesis for the two major equity markets in India for the period to The evidence suggests that the series do not follow random walk model and there is an evidence of autocorrelation in both markets rejecting the weak form efficiency hypothesis.

Search Scope All Authors Title Abstract Index terms Full Text.