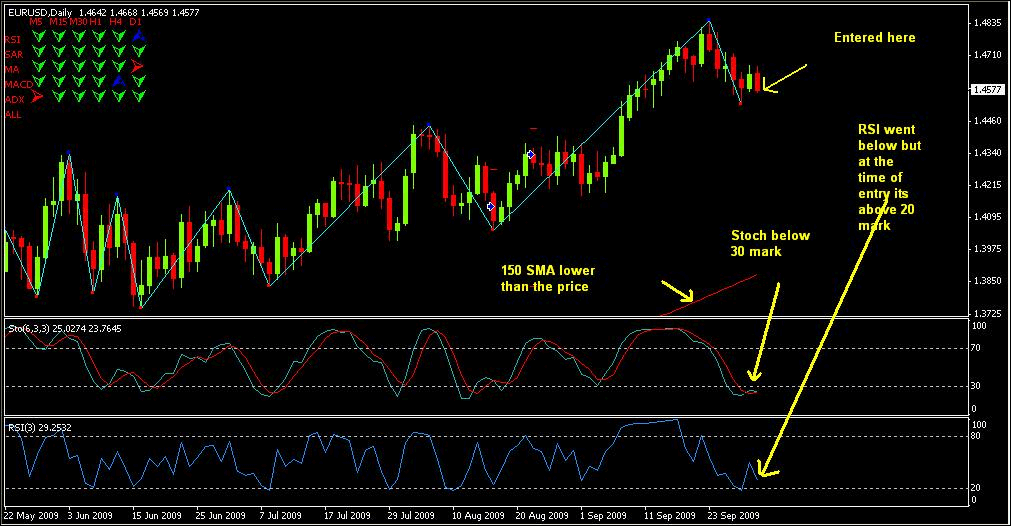

Stoch rsi strategy

Code your Technical Analysis strategy « Z-Connect by Zerodha

An indicator used in technical analysis that ranges between zero and one and is created by applying the Stochastic Oscillator formula to a set of Relative Strength Index RSI values rather than standard price data. Using RSI values within the Stochastic formula gives traders an idea of whether the current RSI value is overbought or oversold - a measure that becomes specifically useful when the RSI value is confined between its signal levels of 20 and The StochRSI is deemed to be oversold when the value drops below 0.

Conversely, a reading above 0. Dictionary Term Of The Day. A measure of what it costs an investment company to operate a mutual fund.

Latest Videos PeerStreet Offers New Way to Bet on Housing New to Buying Bitcoin? This Mistake Could Cost You Guides Stock Basics Economics Basics Options Basics Exam Prep Series 7 Exam CFA Level 1 Series 65 Exam. Sophisticated content for financial advisors around investment strategies, industry trends, and advisor education. What is the 'StochRSI' An indicator used in technical analysis that ranges between zero and one and is created by applying the Stochastic Oscillator formula to a set of Relative Strength Index RSI values rather than standard price data.

Content Library Articles Terms Videos Guides Slideshows FAQs Calculators Chart Advisor Stock Analysis Stock Simulator FXtrader Exam Prep Quizzer Net Worth Calculator. Work With Investopedia About Us Advertise With Us Write For Us Contact Us Careers.

Get Free Newsletters Newsletters. All Rights Reserved Terms Of Use Privacy Policy.